Limited recourse borrowing arrangements to acquire property in an SMSF require a series of formalities to be followed if adverse stamp duty costs are to be avoided. Caroline Harley details the five critical elements to get right with these transactions.

Limited recourse borrowing arrangements (LRBA) allow a superannuation fund to borrow under strict conditions. Although LRBAs are not in the same class as nuclear physics in terms of complexity, they should not be underestimated.

Many advisers source cheap bare trust deeds from document providers, thinking the job is then done. Nothing is more dangerous. The transaction viewed as a whole has a multitude of traps for the unwary and inexperienced – traps that can cost the fund a lot of money.

If you don’t get the basics right, then the compliance of the transaction is likely to be lost and you will pay far more stamp duty than necessary. Here are the top five things you need to know when setting up a compliant LRBA for the purchase of real estate:

- the timing of the contract in relation to the holding trust deed,

- the importance of the purchaser’s name on a contract,

- how to pay the deposit correctly,

- inclusions allowed on the contract, and

- issues when purchasing property off the plan.

Limited recourse borrowing refresher

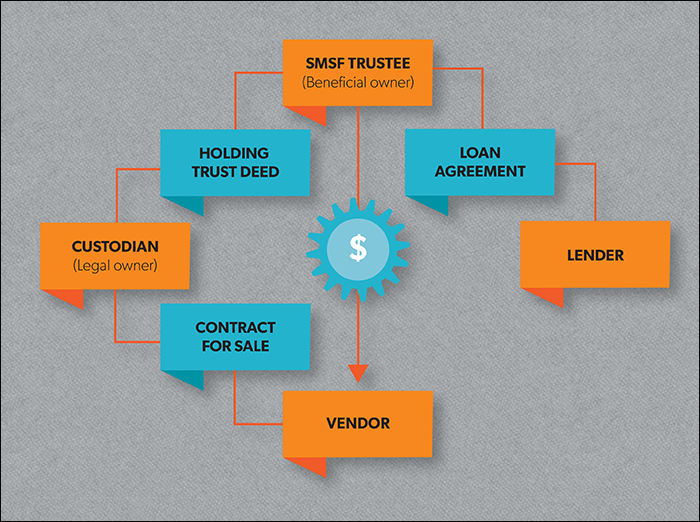

For those who have not yet jumped into the waters, an LRBA for a real estate purchase is when:

- the SMSF trustee borrows from a lender to buy property (in the event of default the rights of the lender must be limited to the property purchased),

- the SMSF trustee has an agreement with a holding trustee that the holding trustee will hold the property for the super fund, and

- the holding trustee enters into a contract and buys property from the vendor using money from the SMSF trustee.

Figure 1: How an LRBA for a real estate purchase works

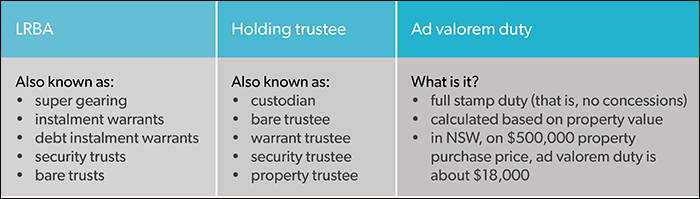

Table 1

Terminology

There are many different names, but the transaction rules remain the same.

Timing of contract

Like anything in life, timing is everything. For LRBAs you need to know which comes first, the contract or the holding trust deed. Why does it matter? Two words: stamp duty.

If you get the order wrong, you could end up paying ad valorem duty three times instead of only once. For example, in New South Wales, on a $500,000 purchase price, ad valorem duty is $18,000. When it goes wrong you could pay ad valorem duty on the contract of sale, again on the holding trust deed and again on the eventual transfer back to the SMSF trustee.

The first thing you need to ask is what state is the property in? As each state and territory has different stamp duty laws, this means the rules change for the order of signing documents based on where the property is located.

If the property is in NSW, Tasmania or the Australian Capital Territory, the contract must be signed and dated before the holding trust deed. If you get it wrong, you could pay ad valorem duty on the holding trust deed as a ‘declaration of trust’ as well as ad valorem duty on the contract.

If the property is in South Australia, Queensland or Northern Territory, the holding trust deed must be signed and dated before the contract. If the property is in Western Australia or Victoria, you can sign the contract and holding trust deed in any order, although it’s often easier to sign the contract first. This ensures documents are only prepared once the purchase has been agreed on and progressed to exchange.

Purchaser on contract

There are some very specific requirements in some states and territories when identifying who the purchaser is on the contract.

In NSW, Victoria, Tasmania, the ACT, South Australia and Queensland, the purchaser should be the name of the holding trustee only. There should not be any references to “as trustee for the bare trust” or “as trustee for the SMSF”. If you get this wrong, it may result in adverse stamp duty implications.

A corporate holding trustee is the smartest way to go, and this is usually the first step in any LRBA irrespective of where the property is located. Set up a company that can act as the holding trustee. Why is a company better? Companies don’t die, they don’t lose capacity and they don’t get divorced, so it is easier to change the directors rather than the names of individuals on a property title. Also, many lenders won’t lend unless the holding trustee is a company.

Some members want to use their own name as the purchaser and note ‘and/or nominee’, that is, “Jack and Jill Mogul and/or nominee”. In some states, such as NSW, this could result in ad valorem duty being charged when Jack and Jill nominate the holding trustee as the alternative purchaser, as this can be seen as a ‘sub-sale’. Currently Victoria is the only state where ‘and/or nominee’ can be used, but you should check the rules with a local conveyancer.

The name of the purchaser on the contract for NT property is very specific. It needs to be “Holding Trustee Pty Ltd ACN as trustee for Name of Holding Trust as bare trustee for Fund Trustee Pty Ltd ACN as trustee for Name of Fund ABN”.

In WA, the word ‘for’ must be used between the holding trustee and SMSF trustee names. It should be “Holding Trustee Pty Ltd ACN for Super Fund Trustee Pty Ltd ACN”.

Paying the deposit

The payment of the deposit is important: firstly when the holding trust deed is being stamped (unless the property is in Queensland, which does not require stamping) and secondly when the loan has been repaid and the property is transferred back to the super fund. For these two events you need to be able to show that all money for the purchase came from the SMSF trustee in order to be eligible for concessional stamp duty. The deposit must only be paid from the fund trustee’s bank account.

What about using other methods for paying the deposit? Deposit bonds are a type of insurance that guarantees the deposit will be paid by the purchaser at settlement in exchange for a fee. Bank guarantees are a surety from the bank to a third party (vendor) where only the third party can demand payment (the deposit). Again, this is set up for a fee. When you consider using either a deposit bond or bank guarantee for the deposit in an LRBA, you must check the actual wording and relationship created before signing. Better to be safe than sorry and run the wording past your superannuation lawyer to make sure it’s compliant.

Inclusions on the contract

Contracts list things that are to pass with the sale other than the land and the main structure. These are generally called inclusions. Inclusions can be split into two types: fixtures and chattels.

Fixtures are part of the land and therefore pass with the real estate. They are part of the single acquirable asset that the SMSF is purchasing and can be purchased using the borrowed money. Chattels are separate from the land and are each in themselves a single acquirable asset. As such, a separate loan would be needed for each chattel.

What is a fixture and what is a chattel? There is a considerable amount of common law on the definition of a fixture, but according to the ATO’s SMSFR 2012/1, a fixture is something that is permanent in nature and not easily removed and significant in value relative to the value of the property. Depending on the property, an example could be ducted air-conditioning.

The same ruling clearly indicates furniture packages are chattels. If you can pick something up and move it, it is likely to be a chattel. If you are unsure if something is a fixture or a chattel, check with your conveyancer as definitions can vary from state to state.

How can chattels be purchased? They can be noted in the contract as passing free of charge or under a separate sale agreement. Make sure there is no borrowing to purchase chattels.

Purchasing property off the plan

An off-the-plan purchase is when draft strata plans are used to sell home units not yet constructed. The issue for LRBA transactions is that the final title particulars are not available at the time the contract is signed.

For NSW, Tasmania, the ACT, WA and Victoria, where the contract is signed before the holding trust deed, the draft title particulars are used for the contract but not in the holding trust deed. You should wait until final title particulars are issued (just before settlement) and include them in the holding trust deed before it is signed. This ensures the holding trust deed contains the final title particulars and there is no confusion as to which piece of land the agreement relates to.

For SA, Queensland and the Northern Territory, where the holding trust deed is signed before the contract, the draft title particulars are used for the contract and the holding trust deed. As only draft particulars are known at the time of signing the holding trust deed, it is best to attach a copy of the contract to the holding trust deed. This will remove any confusion as to what land was purchased using the LRBA.

Why is the description of the property in a holding trust deed important? The stamped holding trust deed is used when applying for concessional stamp duty on the transfer back to the fund (when the loan has been repaid). If there is uncertainty as to which property the holding trust deed identifies, there may be problems in obtaining the concession. Full ad valorem duty could be charged on that final transfer.

One thing is clear: you must be certain on how the property is described now. Not just the street address; the whole real property description. Get a copy of the contract to make sure you get it right.

Potential adverse stamp duty and non-compliant events can be avoided. You should now be able to avoid rookie mistakes such as the contract and holding trust deed being signed in the wrong order, the purchaser name on the contract being incorrectly noted or payment of the deposit using a member’s personal bank account. When these transactional errors occur, it causes stress for you, your clients and your professional indemnity insurer. The only one happy with the outcome is the Duties Office.

Advice:

Getting good advice about the whole transaction before you or your clients dive in is essential. Taking the initial steps carefully will prevent the stamp duty sharks from circling and help to ensure that the foundation of the transaction is as safe as houses.