While the SMSF sector continues to grow, providing opportunities for the provision of financial advice, there are very few specialist advisory practices servicing the market with significant scale. Grant Abbott outlines the critical steps to putting together a successful SMSF advice business.

“If your business depends on you, you don’t own a business – you have a job. And it’s the worst job in the world because you’re working for a lunatic.” – Michael E Gerber, The E-Myth Revisited

The SMSF Industry has grown from nothing to more than $620 billion in the past two decades, with wealth spread over 540,000 families. In terms of global scale, it is the third largest superannuation sector – and we are not talking about the entire Australian super sector, just SMSFs – in the world, with the Japanese and Norwegian government super sectors only larger. What an opportunity for Australia, and with 98 per cent of all SMSF savings invested in Australia it has been a great backstop to our country’s balance sheet, particularly following the global financial crisis. So with that slice of the global savings pie you would think Australian banks as well as international investment banks and private equity funds would be throwing billions of dollars into capturing a slice. Even a 10 per cent market share will parlay into $100 billion by 2020.

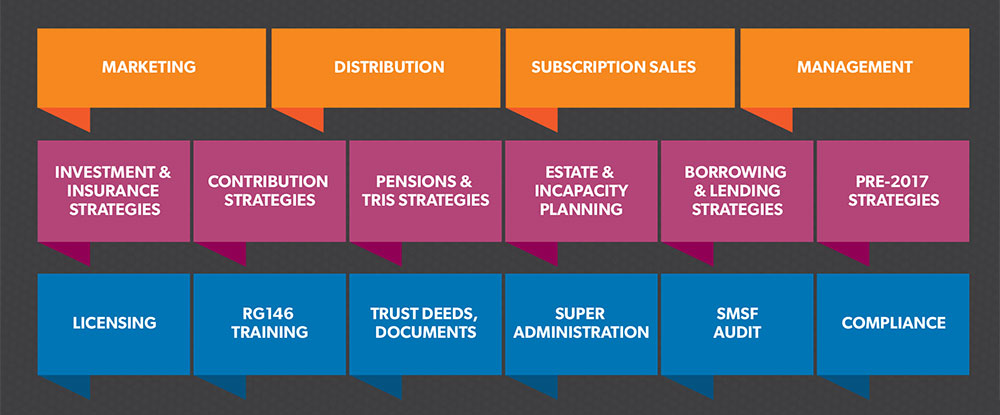

Daigram 1: The SMSF advice business success model

But here’s a reality check. Even with these big stakes in play, there has been no comprehensive SMSF advice provider; plenty of administrators, but no big SMSF advice franchises or concerns. The closest to making a big play is Dixon Advisory. Dixon is the standout in terms of advice, with more than 8000 SMSF clients and over 43,000 monthly page visits to their site, plus a comprehensive advertising program built around the founders, Daryl Dixon and Max Walsh. If there was anyone to back, they are the leaders by a country mile.

As I said earlier, in terms of administrators there are some big ones and none bigger than AMP with more than 20,000 SMSFs under administration. I fully expect that number to grow to more than 50,000 SMSFs within the next five years and possibly higher with some merger and acquisition activity. It is a big space and expect cutthroat pricing over the next five years, particularly on the software side with a number of new players coming into the market. On the planning side, a number of the wrap platforms are trying to capture SMSFs by offering establishment within the platform, but really it is too late and a case of the tail trying to wag a very big dog.

So why are administrators so good at garnering big business in the SMSF space and why are there only a few small players in the SMSF advice space? Diagram one is my updated SMSF advice business model. I created this in 1999 and it has been continually updated, but stands the test of time. As you can see, administration plays a small, important part in the equation, but it is not the business itself. It is part of the foundation, just like documentation and licensing is an important foundation on which the advice and investment strategy revenue lies. Above that are the key business drivers – management, distribution and cash-flow subscription. And where did I learn all this business modelling?

Well in 1999 I had the great opportunity and good fortune when creating, with a committee, the education program for the Sydney Financial Planning Association conference to meet and interview Michael Gerber of the E-Myth fame. For those in the SMSF industry it is a must read as well as his follow-up book, E-Myth Mastery. In short, Gerber states in his E-Myth book: “Most entrepreneurs are merely technicians with an entrepreneurial seizure. Most entrepreneurs fail because you are working IN your business rather than ON your business.” I am sure you have heard that before and I must admit I have fallen into this trap previously.

In 2014, at the NowInfinity Maui conference for SMSF advisers, Gerber really went to town on our industry, noting there are no replicable systems or methodology to provide consistent, value-added advice for clients, as well as a clear, concise eco and business system to hold them for life. He saw the opportunity in the market and we promised to share our views on business models and more importantly the SMSF advice business model. And to get it right in these times is crucial. Clients want value and relationships, not robots. But we in business want the robots to do the horrible administration, dead lifting and anything to reduce fixed costs and provide a predetermined outcome. We are still working on it, but the seven steps below reflect my current thinking on the perfect SMSF advice business that can be scaled easily and efficiently.

Opportunity: With the comprehensive budget changes impacting on many accounting clients, whose advice situation has changed but they must comply with the amendments by May 2017, it is a pivotal time for a launch based on key strategies to help clients, particularly those significantly affected by the $1.6 million pension transfer limit.

Seven steps to a succesful SMSF advice business

“The Entrepreneurial Model has less to do with what’s done in a business and more to do with how it’s done. The commodity isn’t what’s important – the way it’s delivered is.” – Michael E Gerber, The E-Myth Revisited

Overview

I have detailed below the seven key features that provide the deliverables from an SMSF advice business standpoint. Ideally these would be built from a dealer or licensee group level. This provides strong leverage, consistent messaging and branding, plus the all-important compliance. If everything is provided and driven centrally, then it enables the adviser to do the most important thing, that is, to get in front of the client and deliver strategy, motivation and quick implementation.

1. Strategy and business training

It is vital to have strong training and not just generalist SMSF concepts – it must be a strategy course. Not overly technical, although review of relevant parts of the legislation and rulings is crucial, it is how to turn these to strategies into profit. Let’s face it, at the end of the day strategies should be productised rather than customised.I am currently building a strategy-based course that assumes generalist knowledge – watch out for this shortly. It is designed to provide education, competence and advanced strategies for advisers to use with clients, including:

- building a family super fund,

- making contributions over the caps,

- reserves to minimise the new pension benefit limit,

- estate planning, including SMSF wills and auto-reversionary pensions, and

- segregated versus pooled investment strategies under the new pension budget regime.

Insurance strategies include limited recourse borrowing arrangements for managed funds, exchange-traded funds and properties.

Importantly, the course focuses not only on the underlying features of the strategy, but more importantly the business side, including:

- which client demographic the strategy best suits,

- targeting current clients,

- building educational and motivational communications to get sign up for strategies,

- adding leads and prospecting leads,

- using specific SMSF strategy client data capture forms,

- the importance of using specialist SMSF paraplanners to deliver advanced strategies quickly and effectively, and

- costings for clients.

2. Establish strategic client and prospecting communications

Once the adviser group is trained, the next step is for purpose-built communication targeted to specific demographic groups to be applied with the purpose of delivering appointments for advisers. This includes the current client cohort and also prospects that will be garnered from Facebook campaigns and using marketing funnels to distil the right client look and feel.Special-purpose communication strategy pieces will use premier SMSF content but delivered under the adviser’s nameplate, including:

- An overall marketing and communications plan should be designed by and agreed between the parties to be implemented, including the following items:

- Social media posts of strategy videos twice weekly onto Facebook, Twitter and LinkedIn. Strategy papers onto the same platforms twice weekly, all with the end goal of going to appointment-setting pages for the specific adviser.

- Email marketing templates prepared for use and covering a specific strategy per month.

- Branded webinars run with the specialist team across their client base with up to five advisers being interviewed on specific strategies for existing client or prospect viewers.

Follow-up lead campaigns for non-attendees and attendees will be run.

3. VIP client seminars

Face-to-face events for advisers and their clients and prospects, a national roadshow of all capital cities, no more than twice a year but one focused on SMSF strategies for year-end to prepare the client and prospect base for a year of work, buy-in to ongoing communications and webinars and strategy setting for family SMSFs.Ideally a strong speaking program and lead speaker and other investment-style speakers sponsoring these events should provide a strong return on investment and also enhance specialist SMSF adviser branding.

Follow-up communication and implementation tools will be provided post-event.

4. Appointment training and closing

Specialist training on conducting specific appointments for strategies, including the development of slide presentations and whiteboard material to enable discussion points. Apart from key strategy points, closing strategies need to be provided to participants in order to obtain the strategy close and costing.

5. Strategy development

Once the data capture is completed and the strategy is identified, then creation and development can occur. This may require high-level question and answer sessions that can be conducted at any time with an in-house or outsourced technical team. This is the same technical team that will support the paraplanning operations to ensure no loss or degradation of the strategy from data capture to technical creation and strategy nuances to delivery of an effective statement of advice (SOA).

6. SMSF paraplanning liaison and SOAs

The main problem with modern paraplanning and SMSFs is the lack of strong templates dedicated to specific strategies and knowledge of paraplanners in relation thereof. There are a number of intensely trained SMSF specialists operating under a paraplanning roof in Australia now that deliver fast, efficient, quality and compliant SMSF SOAs for great value. These also include both investment and insurance modelling if required for fully licensed planners.

7. SMSF documentation

An integral and vital feature of the process is building relevant documentation from a legal perspective. This will be conducted and created through services such as NowInfinity, or for those wanting sign-off through specialist SMSF legal firms such as DBA Lawyers, TGA Legal and Nautilus Law, particularly for cases worth more than $2 million and involving difficult technical matters. This is to provide an umbrella of protection for the business as well as the provision of legal professional privilege.

Well there it is on a platter, my current thinking on the development of a large-scale SMSF advice business. Sure there are some extra cogs in there, but as with all business this is a test and focus, retest and change strategy until it is perfect. Good luck.